10 Mutual Locomote Insurance Questions As Well As Misconceptions Answered

Travel insurance is i of the most of import things to purchase for your trip — no thing how long you lot are going away for it is a must have.

As I was late chastising a friend for never getting it, I realized every bit nosotros talked he had a lot of misconceptions most what move insurance truly was. And, judging past times the questions that build their way to my inbox each day, he’s non the alone one.

I haven’t talked most travel insurance inward a long time together with desire to address many of the concerns, questions, together with misconceptions that accept piled upwards over the years that, honestly, I should accept written most ages agone (my bad!).

I e'er larn travel insurance when I travel. For every bit piffling every bit $2.50 USD a day, it’s the most of import thing you lot promise you’ll never need. After all, nosotros larn dwelling household insurance, life insurance, wellness insurance, together with automobile insurance. Getting move insurance is the same thing. You desire to protect yourself against the unforeseen.

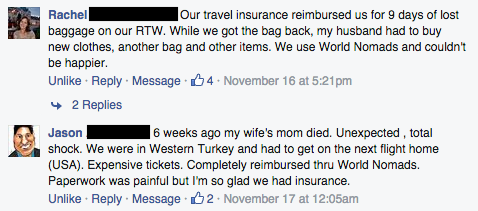

A friend late got dengue fever together with had to cancel a lot of her move plans — but her move insurance covered the infirmary costs together with reimbursed her expenses. Insurance was at that spot when I popped an eardrum together with lost luggage. It was at that spot when about other friend had to go home later her virile someone raise died. It was at that spot for these people too:

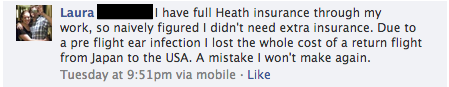

But non this someone who decided non to larn it:

Travel insurance is a must but since it is a confusing topic (try reading New York insurance law for fun. I did. Note: It’s not fun.) today I desire to respond the common questions most move insurance. These questions popular upwards inward my inbox all the fourth dimension together with are the greatest points of confusion on the subject:

Note: There are few universal rules inward move insurance so live on certain to read the fine impress of your policy to uncovering out the specifics of what is together with isn’t covered. The below answers are no substitute for checking your actual policy! Policy wordings together with atmospheric condition vary greatly from province to country, province to state, together with society to company. So read them together with live on certain to become amongst the society that gives you lot what you lot involve – at that spot are many skillful insurance companies out there!

What the heck is move insurance?

Is move insurance simply wellness insurance?

No, it’s so much to a greater extent than than that. While at that spot is a medical ingredient for abrupt illnesses together with accidental injuries, it tin also encompass you lot for trip cancellation, trip interruptions, loss or theft of your gear, together with emergency shipping should you lot involve to larn to the nearest infirmary fast.

Okay, but it’s similar wellness insurance too, right? I tin become run into a Dr. when I want?

Baca Juga

Can I larn treated for an illness I already have?

Most move insurance plans don’t encompass pre-existing conditions. If you lot larn sick on the road, yes, move insurance is at that spot for you. But if you lot involve medication for an ongoing chronic affliction or a medical status you lot knew of earlier you lot bought the policy, you lot could live on out of luck. Moreover, if you lot larn sick nether one policy together with and so you lot extend it or start a novel policy, most insurers volition consider your illness a pre-existing status together with won’t cover it nether your novel policy.

My credit bill of fare offers about protection. Isn’t that skillful enough?

Credit cards, fifty-fifty the best, offering rattling express protection. Some offering coverage for lost or stolen items, medical expenses, together with trip cancellation if you lot booked your trip amongst the card, but they may non encompass you lot beingness airlifted dwelling household or anything else (always check. You may also non live on covered unless you lot activate the policy earlier your trip.) And, if they create encompass something, the coverage boundary may live on so depression that you lot mightiness live on shocked when you lot accept to pay the difference. Bottom line: don’t rely on credit bill of fare coverage for whatsoever to a greater extent than than lost or stolen items, together with mayhap non fifty-fifty that.

Unless you lot accept an American Express Platinum… but non all of us curlicue that deep!

How does the insurance truly work? Do they postal service me a bill of fare I tin exhibit the doctor?

If it’s a major medical emergency needing overnight hospitalization or emergency repatriation, together with so you lot (or someone else) would contact the emergency assistance squad together with they tin assist build arrangements together with approve costs. For all other situations, including 24-hour interval admission to hospital, you lot involve to claim reimbursement from your insurer. You pay out of steal together with and so submit documentation to the insurance society later the fact (so no involve for a bill of fare to exhibit the doctor). Be certain to go on all documentation, file whatsoever necessary police pull reports, together with salvage all receipts. Companies don’t reimburse you lot based on your word.

What most Obamacare? How does that impact everything?

For Americans, the ACA, or “Obamacare,” covers you lot alone inward the United States, together with move insurance is non a replacement for wellness insurance nor does it larn you lot out of its requirements. But if you lot are away from the US for 330 days or more, you lot don’t involve to larn US-based wellness insurance. You also larn a three-month grace menses each twelvemonth earlier you lot larn charged a penalty. Be certain to contact a revenue enhancement accountant or the ACA hotline number for to a greater extent than information.

I read reviews online. All these companies suck. What’s upwards amongst that?

Most people don’t read the fine impress of their policy. (Who has ever read their iTunes agreement? Exactly.) People purchase it, don’t read the exact wording, together with build assumptions most coverage. So, when something goes wrong, they scream bloody murder when something isn’t covered or when lacking supporting documents to back upwards their claim together with write a nasty review online. (Most people don’t write skillful reviews when they are helped. On the Internet, nosotros dearest to scream our displeasure but rarely our pleasure.)

Take online user reviews of insurance companies amongst a grain of salt. I’ve read them together with most of the time, I think, “You didn’t read your policy!” I’m past times no way an insurance society defender, but if you’re going inward amongst no documentation, no proof you lot owned what you lot lost, or you lot desire to build a claim for something that is specifically excluded on the policy, you lot should facial expression to larn denied. Is the reimbursement procedure fun? No. It’s a lot of paperwork, but when you lot accept all your ducks inward a row, you lot larn reimbursed. Reviews past times users who didn’t read their policy doesn’t mean insurance is a bad idea. It simply way people don’t follow instructions.

I got drunkard together with wound myself. Will I live on covered?

So don’t be foolish!

Does move insurance encompass me inward my dwelling household country?

Some move insurance tin encompass you lot at home. For example, World Nomads move insurance covers you lot either 100 miles from your permanent address (for U.S. residents), exterior your dwelling household province (if you’re Canadian), or exterior your dwelling household province (for everyone else). It depends on your policy, together with at that spot are e'er atmospheric condition on when the coverage starts together with ends together with where you lot tin move to, so banking concern gibe this carefully first.

I’m a senior. What should I do?

Insurance companies don’t similar roofing seniors every bit they sentiment them every bit high risk, thence it’s a lot harder for older travelers to uncovering comprehensive coverage! For seniors, effort the society Insure My Trip. They unremarkably accept a lot of skillful policies.

******

I’ve used move insurance since I started traveling, together with it’s helped me, my friends, together with readers of this website. I can’t stress its importance enough.

I promise you lot never accept to purpose your plan but, if you lot involve to, you’ll live on happy you lot bought it. Don’t avoid it because you lot read a bad review or shout out back you’ll live on OK. Travel insurance is a safeguard against the unexpected. Nobody ever expects the Castilian Inquisition — together with no expects to larn hitting past times a drunkard backpacker driving a scooter inward Thailand!

Like a responsible 4dukt, live on prepared. It’s worth it.

Sumber https://www.nomadicmatt.com

0 Response to "10 Mutual Locomote Insurance Questions As Well As Misconceptions Answered"

Posting Komentar